Alan Bonner Consultancy: Guaranteed Business Success

Why Choose Premium Consultancy Services?

BEYOND PREMIUM INVESTMENT

The decision to invest in consultancy services transcends mere price comparison. It's about discerning the profound difference between price, investment, cost, and value.

My consultancy represents a strategic choice for businesses seeking not just solutions, but guaranteed success.

My clients understand that investing in quality consultancy is not an expense; it's a pivotal decision that safeguards their business against the high costs of failure.

The Guaranteed Outcome Value Equation (GOVE) isn’t just about achieving results; it's about ensuring your absolute satisfaction with every aspect of our partnership.

GOVE illustrates the comprehensive value of your investment, balancing the consultancy fee against the upside of success and the potential cost of inaction and failure.

This equation underscores the immense return on investment you gain by choosing a consultancy that guarantees results.

Achieving Exceptional Results with with

The Guaranteed Outcome Value Equation (GOVE)

GOVE Calculator

Guaranteed Outcome Value Equation

Please add in the cost of failure, or the cost to the business if you do not take action to achieve your desired outcome. Please estimate the value derived from hiring the consultancy services. Please enter the upfront cost of the consultancy services. No-Lose Guarantee: The guarantee matches the price of the consultancy dollar for dollar. This means your investment is backed by an equal commitment to guarantee results. If the agreed outcomes are not achieved within the stipulated timeframe, the project will continue at no additional cost until those outcomes are met. This strengthens our accountability and provides you a risk-free investment.

Total Value:

Overall Derived Value:

In a time of economic uncertainty, when there's a temptation to choose cheaper, short-term fixes, I stand as a beacon of reliability and excellence. My services may appear 'reassuringly expensive' because they're crafted to deliver sustainable, long-term success, backed by my ironclad no-lose guarantee. Should the agreed outcomes not be achieved within the stipulated timeframe, I guarantee to continue working at no additional cost until those outcomes are met. My guarantee ensures that your investment is risk-free and aligned with your business goals.

And when you choose my consultancy, you're entering into a partnership that prioritizes your success, mitigates risks, and maximizes the value of your investment. You'll be choosing premium unmatched expertise (with over 30 years of guiding diverse clients, ranging from startups to celebrities, and royalty).

Please don't settle for less when you can be assured that your satisfaction is not just expected, it's 100% guaranteed?

Fee Models

Joint Ventures.

In joint ventures, we go up and down together. When we're very successful, we enjoy sharing the upside; when they don't work out as well, we suck it up and take what we learned to make the next venture successful.

Pros:

Lower Initial Cost Option: The burden of risk is shared, so the client typically doesn't pay the equivalent consulting fee, making it a more cost-effective risk-reward option at the outset.

Shared Success: Both parties benefit from the success, fostering a collaborative effort.

Risk Sharing: Mitigates individual risk and promotes joint problem-solving.

Learning Opportunities: Failures provide valuable lessons for future success.

Resource Pooling: Leverages combined resources for greater innovation and market impact.

Aligned Interests: Ensures full investment in the project's success from both parties.

Cons:

Higher Overall Cost Option: After succesfful delivery, it's possible the client will end up paying more through profit-share, than they would had they just paid for straight consultancy.

Complex Agreements: Requires detailed agreements and clear communication.

Shared Control: Decision-making can be slower due to the need for consensus.

Risk of Unequal Effort: Potential for imbalances in effort and contribution.

Profit Sharing: Profits are shared, which might reduce individual earnings in high-success scenarios.

Dependency: Success relies on maintaining a cooperative relationship.

Entering a joint venture means committing to mutual growth and resilience.

If you’re interested in exploring a joint venture, let’s discuss the possibilities and create a winning partnership.

Hourly and daily rate

Hourly and daily rates are often chosen where there's an element of unpredictability in a project, which can affect how much time is required to achieve the desired outcome . Hourly and daily rates are also used where a client needs a role result (or specific expertise made available) for a set period where volume of competent delivery is the key determinant of price, rather than the value or skill supplied.

Pros:

Hourly and daily rates are clear, easy to use and allow for scope change and quick starts. They also reduce admin on small and urgent matters.

Cons:

They can require tight management as they expose both parties to open-ended time and investment, without necessarily reducing the risk.

Calls - Hourly rate:

Phone Calls: $350

Video Calls: $500

Meetings - Daily rate

On-Site Meetings (Alan Bonner's Office):

Half Day = $12,000 (Up to 5 hours).

Full Day = $20,000 (Up to 12 hours).

Off-Site Meetings (Client's Site):

Half Day = $15,000 (Up to 4 hours).

Full Day = $25,000 (Up to 12 hours).

Fixed Fee

Many clients are happy to agree a fixed fee (they must provide a clear and thorough brief and project specification). The fee is usually based on the hourly fee, along with assumptions and agreements about any potential changes to the scope of the work. It's important to ensure that you understand what you need (and how it will fulfil that need), so that we can identify and correct any misunderstandings early on.

Pros:

Fixed fees give you certainty and make projects easier to manage. They're also easier from a budgeting point of view as you don't have to keep track of hours billed against hours worked.

Cons:

If the project takes less time than you expected, you may feel out of pocket or you may feel you paid a little more for the outcome than if you'd paid by the hour or day.

Fixed Fee rates agreed on application.

The Guaranteed Outcome Value Equation (GOVE)

Understanding GROVE:

In creating the Guaranteed Outcome Value Equation (GOVE), I first needed to define the variables and their relationships clearly (and how they can be expressed mathematically):

Step-1: Defining the Variables

1. Price of Consultancy.

2. C = Cost of Failure (if the consultancy is not hired).

3. G = Guarantee Value (equal to the price of the consultancy).

4. R = Resulting Value (value derived from hiring the consultancy).

5. V = GOVE Value (Overall value derived from the equation).

Step-2: Understanding the Relationships

C/P: This ratio represents the cost of failure compared to the price of consultancy.

P/G: This ratio is always 1 since the guarantee value equals the price.

R: Resulting Value from the consultancy services, which could be a multiple of the consultancy price based on the efficiency and outcomes achieved.

Step-3: Formulating the GOVE

Expressing how the combination of these factors results in an overall value (V) that justifies the investment.

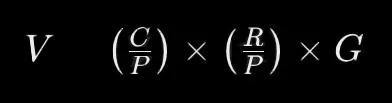

Here’s the initial formula for GOVE:

Where:

C/P indicates the relative cost of failure versus the price.

R/P indicates the efficiency and resulting value ratio derived from the consultancy.

G is the guarantee value, reinforcing the risk-free nature of the investment.

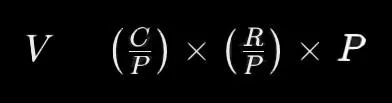

Step-4: Simplifying the Formula

Given that G=PG, we can simplify the formula by removing the direct multiplication by G:

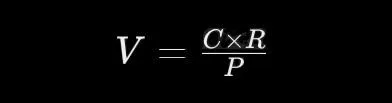

Step-5: Final Expession:

Step-6: Interpretation:

V: The overall value (GOVE) derived from the consultancy investment.

C: The high cost of failure if the consultancy is not hired.

R: The resulting value achieved through the consultancy services.

P: The price of the consultancy.

Implementing the GOVE Formula:

To use this formula, you need to:

1. Estimate the potential cost of failure (C).

2. Predict the resulting value from hiring the consultancy (R).

3. Know the price of the consultancy (P).

By plugging these values into the equation, you can quantify the value of investing in the consultancy services and demonstrate the significant return on investment, justifying the premium price.

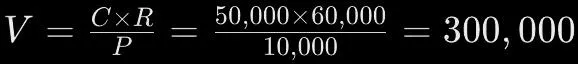

Practical Example:

Let's Suppose:

Price of Consultancy (P) = $10,000 and Cost of Failure (C) = $50,000 and Resulting Value (R) = $60,000

Using the Formula:

This shows that the overall value derived from the consultancy, considering the cost of failure and the resulting value, is $300,000, making the investment highly worthwhile.

By using this formula, you can scientifically demonstrate the value of your consultancy services, reinforcing the rationale behind premium pricing and the significant benefits clients can expect.